The Bank for International Settlements published its data on Payments and Financial Markets infrastructures for 2021 on the 31st January 2023. You can find all the details using the BIS Statistics Explorer that you can find here. But, as usual, I have downloaded all the relevant data sheets and compiled them in a Google Sheet file that you can find here.

The bottom line is that Financial Transactions have continued to grow. For 2021, they reached $15.91 quadrillion, up 6.5% on the previous year, despite the fact that BIS was unable to obtain data from Russia following the Ukraine invasion. So we can probably add in a further $60 trillion (which was roughly the value for Russia in 2020).

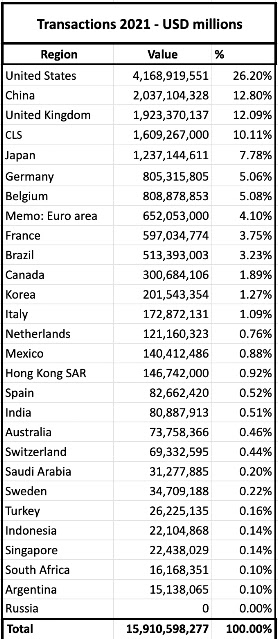

Here are the results by country in table form for the 23 countries included in the BIS dataset. Of course, there are lots of other countries that do not appear in the table, but many of the big players will be there.

One striking feature is the massive increase in transactions for China - up 11.3% since 2020 and allowing it to overtake the UK.

As always, there is also a huge amount of activity associated with CLS group that mentions that it settles around $6 trillion in transactions every day on its website. And, indeed, as you can see from the next table that shows all the players that exceeded $100 trillion during the year, it has now taken the number one spot.

As always, I will again have to regret that BIS still only provides information about "selected" payment systems. I still have no idea why they think that the transactions handled by major players including the Options Clearing Corporation do not need to be included. OCC describes itself as "the world's largest equity derivatives clearing organization". It cleared a staggering 10,377,923,457 transactions in 2022, double the quantity in 2019 - their figures are all here. Despite my efforts, I have been unable to determine the value of the those 10 billion deals. But, in many cases, we are talking about deals that can be worth millions of dollars each. It might be that the value of the transactions handled by OCC alone could dwarf everything that BIS reports.

The critical point is that if there was a political will, it would be trivial to solve many of the problems facing humanity with a tiny 0.1% tax on these transactions. Even if we just take the numbers provided by BIS, the revenue generated would be more than enough to provide a basic income of $100 a month for every one of the 8 billion people living on our planet - total cost less than $10 trillion a year. A large sum, but less than one thousandth of the value of transactions.

And before anyone says that it would be unfair to target the traders who are responsible for a lot of that activity, just remember that I am proposing that everyone would pay exactly the same percentage. When my salary comes in to my bank account, 0.1% would be taken in tax. Every time I use my credit card or pay my electricity, telephone, or food bills, I would pay 0.1% as well. Would I object? No. I would be happy to know that my money was being used to improve the well being of all my fellow citizens.

Of course, some will argue that any tax on financial transactions will cause the volumes to drop. Would that be a bad thing? What useful function is provided by the $6 trillion a day in transactions handled by CLS group, or the 10 billion transactions settled by OCC? I believe that if only a tiny fraction of that money was injected into the real economy, then almost everyone would benefit.

No comments:

Post a Comment