Now that I have compiled all the data from the Bank for International Settlements on Financial Transactions in the 10 year period between 2006 and 2015, I can now give you all the gory details of where most of the action is. As noted in my earlier post, the BIS data sums to around $105 quadrillion - $105,206,803,900,000,000 - a one with 17 zeros after it. Call it 100 petadollars if you prefer.

The BIS data sets can be broken down into 326 different streams, involving the 23 countries that are covered by the CPMI (Committee on Payments and Market Infrastructures). The full data set can be downloaded in the form of an Excel file here,

Here, I will just give you the top of the table - namely the places where, in the last 10 years, over $1 quadrillion in financial transactions have occured.

As you can see, just 23 sites and platforms accounted for over 80% of the over $100 quadrillion in transactions that have occured in 10 years. The other 300 or so, only involved about €21 quadrillion. So let's look at the big guys.

CLS group, which describes itself as the world's largest multicurrency cash settlement service, settling foreign exchange (FX) trades across 18 currencies, has processed over $11.4 quadrillion in transactions over the ten year period. It was set up in 2002, and currently settles around $5 trillion every day. The peak values reached $10.7 trillion in a single day in 2014 - see the 2015 annual report for more details.

The next biggest player is the Government Securities Division (GSD) of the Fixed Incorme Clearing Corporation (FICC) in the USA which handled over $10.1 quadrillion in ten year.

The European Central Banks TARGET system has done over $8 quadrillion .

Next comes Fedwire, which used to be called the Federal Reserve Wire Network, and is a real-time gross settlement funds transfer system

operated by the United States Federal Reserve Banks that enables

financial institutions to electronically transfer funds between its more

than 9,289 participants. Fedwire handled nearly $7 quadrillion over ten years.

Number 5 in the list is a really intriguing one. Based in the UK, LCH Clearnet Ltd was handling over $1.5 quadrillion a year in 2008, but mysterioulsy, their figures have been "nav" (not available) for the BIS since 2010. As a result the total over ten years is a mere $4.7 quadrillion, but the real figure could is probably huge.

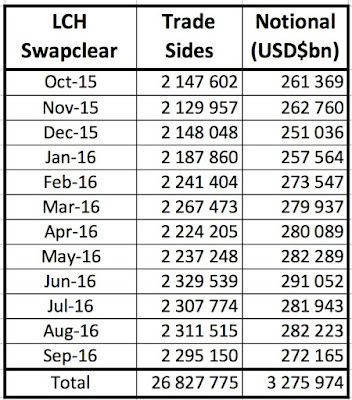

In fact, it's not that difficult to find figures from LCH. For example, just go to their website and it's not difficult to learn thatSwapClear service handled 26.8 million trades in the past year, with a notional value of over 3.2 quadrillion - $3,275,974,000,000,000 to be precise. Here's the summary

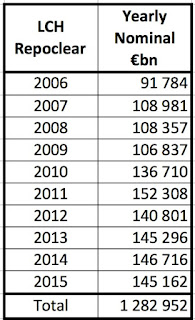

And that's just SwapClear. Go to LCH's Repoclear page, and you can see that there have been another €1.28 quadrillion in trades in the last ten years - note those are euros, not dollars.

LCH's CDSClear Volumes page proudly takes about a Gross Notional of €879,584,202,352 since its inception. Add in the numbers of CommodityClear, ForexClear, and EquityClear

and it is clear that LCH is handling a truly mindblowing volume of financial transactions. Shame that BIS doesn't think it necessary to ask them for the details.

The list goes on : EuroClear in Belgium has done over $4 quadrillion, so has the CHIPS system in the USA (Clearing House Interbank Payments System) which is a bank-owned privately operated electronic payments system.

If you go to the bottom of the file, you will see that the following key players have figures that for BIS have been "nav" (Not available) every year since 2006.

Surely, BIS could do better. Can't they just ask

the London Stock Exchange, the Australian Stock Exchange and the

American Stock Exchange to provide the figures? And it it's not

possible, why do they even bother to include the "nav" figures at all?

And

of course, do I have to remind you that the $100 quadrillion in the BIS

dataset fails to even mention what is quite probably the biggest player

of them all - the Options Clearing Corporation, based in Chicago, that has been handling 4 billion transactions a year since 2012. The premiums alone on those transactions in 2015 totalled

$485,268,422,301. I'm afraid I don't know the ratio between the

premiums and the actual transactions, but I suspect that we are talking

about incredible amounts. OCC doesn't even get a mention in the BIS

data set. Incredible.

The

details may be tedious, but for me, the bottom line is simple. There are

collosal amounts of money being moved back and forward by the financial

markets everyday. None of this is subject to taxation. Why is it that

the traders and bankers that have bought and sold over $100 quadrillion

dollars worth of something or other never have to pay any tax, while you

and I have to pay 20% or more in sales taxes for things that are

actually useful.

Surely, the conclusion is simple. We should abolish

essentially all the existing taxes on sales, incomes and profits, and

simply tax every single financial transaction. The same rate should

apply to all transactions. You and I would pay the same to use the money

system as everyone else - including bankers and traders. Believe me, if

those $100 quadrillion in transactions over the last ten years

(massively underestimated!) had been taxed at even 0.05%, we would all

be much better off.

See my TEDx talk (in French)

if you want to know more. And if you would like to hear an updated

version in English, let the people at TED know! This message needs to

get out. We are stupid if we let the current system continue.

No comments:

Post a Comment