The new Labour government in the UK has good intentions, but will be severely hampered by lack of money. They are committed to not raising taxes, but it is unrealistic to imagine that everything can be fixed without some extra income.

Tax Justice UK has sent the UK government a list of 10 tax reforms that should raise an extra £60 billion for public services and a fairer economy that you can find here. This is their list

1 – Apply a 2% wealth tax on assets over £10 million, raising up to £24 billion a year

2 – Equalise capital gains and income tax rates, to raise £16.7 billion a year

3 – Apply National Insurance to investment income, raising up to £10.2 billion a year

4 – Close inheritance tax loopholes to raise £1.4 billion a year

5 – Close the loopholes in the new non-dom scheme to raise up to £1 billion

6 – Introduce a 4% tax on share buybacks, raising approximately £2 billion a year

7 – End fossil fuel subsidies for oil and gas companies to raise £2.2 billion a year

8 – Close the loophole in the oil and gas windfall tax, costing £2 billion a year

9 – Tax private jets to raise £700 million a year

10 – End tax reliefs that benefit huge multinational corporations

All of them seem fair enough. The first one, applying a 2% wealth tax on assets over £10 million is close to one of the proposals of the UK Green Party, although the Greens are apparently only proposing a 1% tax increasing to 2% on fortunes of over £1 billion.

Other people have recently been proposing wealth taxes that specifically target billionaires. Earlier this year, ministers from Brazil, Germany, Spain and South Africa signed a motion at the G20 meeting proposing that the world's billionaires should pay a minimum 2% wealth tax. And a study by French economist Gabriel Zucman, commissioned by the Brazilian government demonstrated that such a tax was technically feasible. Zucman said that billionaires were currently only paying 0.3% tax on their wealth. And this was despite the fact that the average wealth of the top 0.0001% of individuals had grown by 7.1% a year on average between 1987 and 2024, increasing their share of global wealth from 3% to 14%.

It's true that, according to the Forbes 2024 billionaires list, the UK can boast 55 billionaires. Here they are, and together they have $225.3 billion dollars in wealth. That might raise about £3.5 billion if you taxed at 2%.

But I note that 55 billionaires is less than 2% of the 2781 dollar billionaires in the world. And their total wealth is only 1.5% of the $14.2 trillion total.

Given the fact that the UK is the world center for offshore banking, I think we can safely assume that much of that wealth would end up shifting to tax havens. Poor Philip Green, who only just made the list this year with $1.2 billion might already have quite a bit of cash in Monaco thanks to the fact that his wife lives there for tax reasons.

So, for me, the solution is not to target billionaires in particular, or even just those with only £10 million. That sort of targetting will lead to massive lobbying, despite the fact that a small number of ultra-rich people are begging to pay more tax. There is even an organisation called Patriotic Millionaires UK, a sister group to the Patriotic Millionaires group in the USA. The UK based version includes 50+ millionaires who want to do more. They include Gary Stevenson, James Perry, Phil White, Graham Hobson, Gemma McGough, Kristina Johansson, Julia Davies and Tim Stumpff - Good on you!

No, my proposal to Keir Starmer would be to introduce a 1% on all net wealth. No arbitrary figure of £10 million for the 1% rate, or £1 billion for the 2% rate. Such thresholds automatically trigger defensive reactions from the people with the wealth, leading them to lobby against such measures, and encouraging them to shift their wealth elsewhere.

In contrast, if everyone with net wealth paid 1%, it would hopefully make the richest people feel less justified in cheating the system.

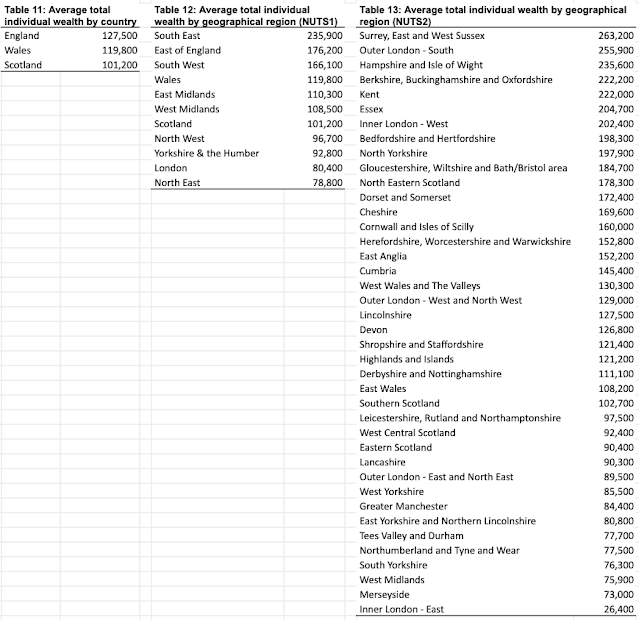

So who would pay in such a scheme. Well, the UBS Global Wealth report gave a figure of $163,515 for median wealth in the UK (£128,000), which by definition means that half the population would pay less that £1280 a year. A more detailed analysis can be based on the figures from the Office for National Statistics. Here's the distribution according by decile.

You can see that the bottom half of the population has only 5.9% of the wealth, and that for the first decile, the tax due would be minuscule (0.02% of the total tax take).

But everyone would be contributing equally. No specific targetting of millionaires and billionaires. That's fair.

There are lots of other really interesting bits of information in the ONS data. Here's a graph of wealth by centile. But by downloading the data, you can see that 1% of of the population have negative wealth.

It's unfortunate that the latest dataset is over 5 years old, because I

am certain that after Covid and five more years of Tory austerity, the

number of people with nothing will have increased a lot. You want proof? Just look at how the use of food banks has soared since 2008.

One of the biggest factors determining the amount that would be paid with a 1% wealth tax is age, as you can see from this figure.

Adults under 25 would only £223 a year on average. Between 25 and 34 this would increase to £768, then £1910 between 35 and 44. The wealth tax for those between 45 and 54 would be £3660, for those from 55 to 64 it would increase to an average of £5534, while those of State Pension Age and above would contribute and average of £4687.

Are these figures unreasonable? I don't think so. Because it is not as if the tax payable is determined by your age. Someone in their 50s who is renting, has no pension pot, and no savings would pay essentially nothing. But it shifts the effective tax burden away from young families with children who are often heavilly in debt because of university loans and mortgage payments.

So my message to Keir Starmer and his government is simple. Yes, you need to tax wealth. But please, don't do it by having arbitrary tax bands for people with headline levels of wealth. A flat 1% wealth tax would, according to the figures from the UBS Global Wealth Report, which puts the UK in 13th position with €350k per adult in net wealth (around £270K), generate £148 billion a year. That's a lot more than even the 10 reforms proposed by the Tax Justice UK group.