To get some idea of how much revenue would be generated by an annual asset tax of 1%, I thought it would be interesting to have a close look at Forbes World's Billionaires List for 2023 which is available here. As the Forbes website points out, they counted "2,640 ten-figure fortunes, down from 2,668 last year. Altogether, the

planet’s billionaires are now worth $12.2 trillion, a drop of $500

billion from $12.7 trillion in March 2022". I'm not sure that we have to feel very sorry for them for the fact that they have lost a bit over the last year.

I downloaded the data set from the website and generated a Google Sheet that you can find here. (It was actually quite hard work, but well worth it I think).

One thing I did was to generate a table of the asset value (Net worth) of the billionaires by country. Here's what that generates

The list is headed by the USA, China and India. But, given that I live in France, it was particularly interested to see that France comes fourth in the ranking, with 43 billionaires who have total net wealth of $590 billion.

Obviously, that is helped by the fact the world's richest billionaire is Bernard Arnault and family, who are based in France. They have a net worth of $211 billion. But, if you are interested, here is the complete list of all 43.

My congratulations to all of them. The names at the top of the list show that France is really very important in the world of luxury goods. Nothing wrong with that.

It follows that if Emmanuel Macron were to impose a 1% global tax on Net Worth for all French residents, it would immediately generate a very useful $5.9 billion in revenue - around €5.4 billion - just from the first 43 people on the list.

But, just to be clear, I'm not proposing a 1% tax that would only apply to billionaires (or even those with net worths of €10 million or more). I would apply the 1% to the net worth of everyone - including me! It's called being fair.

And I honestly don't see why France's 43 billionaires could complain about having to cough up 1% of their fortunes every year if absolutely everyone was treated in the same way.

A recent study by the French government institute (INSEE) found that 50% of French households have a net worth of over €177,200, meaning that if my proposed asset tax was introduced, they would be paying at least €1772 a year in wealth tax, rising to around $2 billion a year for Bernard Arnault and his family. That's perfectly fair, and easy to implement. This seems to me to be a much simpler system than the taxes that many people seem to want, in which there is a hard threshold for paying an asset tax.

Indeed, if you look at the decile distribution of wealth in France, you find that the bottom 10% of households have net debts of €4700. Hey, that suggests an extremely simple scheme where you pay 1% of your net wealth in tax per year, but that if you have net debts, you get 1% back as a handout. A simple implement of a basic income scheme.

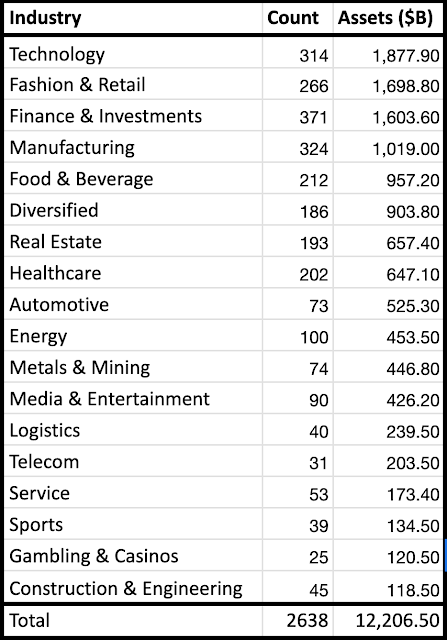

I also looked at how the wealth was distributed according to the type of industry. Here's the result

You can see that Tech billionaires are particularly significant, But Fashion & Retail, Finance & Investments, and Manufacturing are also important, with over $1 trillion in assets for each area.

But, as you can see by comparing these figures with my post yesterday, all these individual fortunes are totally dwarfed by the assets held by the 2000 biggest corporations in the world. The Forbes Global 2000 companies have combined assets of $231 trillion. That is around 20 times more than all the wealth held by all the world's 2638 billionaires. There's really not much point in picking on billionaires alone.

And, surprise surprise, the vast majority of those assets are held by banks and financial institutions. They should be the number one target of my proposed global 1% asset tax. Sure, there are 371 billionaires who have made fortunes in Finance and Investments - and they have a combined net worth of over $1.6 trillion. But this is peanuts compared with the assets held by banks.

How come nobody ever suggests taxing them?

Could it be that the banking system manages to avoid anyone ever raising that possibility? Maybe they have a way to influence what the media talks about, what economists talk about, and what our politicians propose?

Until there is a political party who is prepared to put a 1% global tax on assets on their program, we will effectively have no chance to change the way the system is rigged in favour of banks.

No comments:

Post a Comment