As you can see, from the word go, Germany has been taking full advantage of the new ECB program, with an average of well over €11 billion of purchases a month. And, between them, the central banks of the various Eurozone countries have managed to buy up over €545 billion in assets - essentially government bonds - since the start of the program.

Given that this table shows essentially the purchases of government bonds by central banks of the Eurozone countries, you might be tempted to think that the result of this could be a reduction in the level of public sector debt in those countries. After all, isn't it almost as if the ECB had authorised the National Central Banks to buy up the debt of those countries?

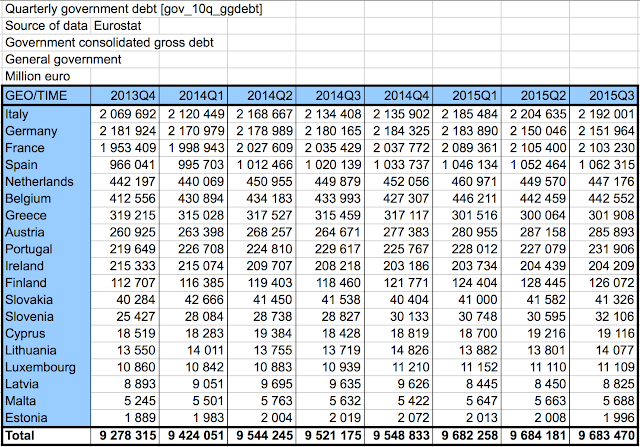

To check on this possibility, I looked at the latest figures from the Eurostat website on the level of public sector debt in the Eurozone countries. Eurostat provides the numbers every quarter, and the latest figures are those for the third quarter 2015. Here are the official figures for the last 8 quarters.

As you can see, total Eurozone debt at the end of the third quarter 2014 did drop a bit- by about €700 million, but this was absolutely trivial relative to the total level of debt - namley €9.68 trillion - a value that has stayed almost exactly the same for the past three quarters. In other words, is doesn't appear to be the case that Mario Draghi's €60 billion a month is being used to reduce the levels of public sector debt in the Eurozone countries. So what is it doing?

If I have understood correctly, our governments are still borrowing like crazy by selling bonds to the commercial banking system. The only difference is that now, those banks can sell those bonds to National Central Banks who have been authorized by the European Central Bank to create around €60 billion a month. In effect, rather that using that money to finance governments, the current mechanism means that the new ECB money appears to be going directly into the pockets of the bankers.

I've not yet got a full understanding of the underlying mechanism, but in the case of France, I have seen that the French government has been emitting new long term bonds as frenetically as ever. You can see this by checking out the activities of the Agence France Tresor, the official organisation that is charged with handling French Government Debt. On their website, you can find details of all the operations that they were involved in during 2015. I've downloaded all the monthly files and found no evidence whatsover for a slow-down in the rate at which they have been emitting new government bonds (or OATs, to use the term used by the French Authorities) during 2015. It's not possible to know exactly who has been buying French bonds, but we know that only authorized primary dealers can buy up such bonds. There are 18 of them - and they are all commercial banks - and the list of those primary dealers can be found here.

However, while we don't know exactly what each of those banks has been doing, we do know the list of the most active primary dealers, because this information is provided on the AFT site. Here is the list of the most active primary dealers in 2015:

- 1 BNP Paribas

- 2 Morgan Stanley

- 3 Crédit Agricole

- 4 Société Générale

- 5 HSBC

- 6 Barclays

- 7 Natixis

- 8 JP Morgan

- 9 Royal Bank of Scotland

- 10 Citigroup

- 1 BNP Paribas

- 2 Société Générale

- 3 JP Morgan

- 4 Crédit Agricole

- 5 Barclays

- 6 Nomura

- 7 HSBC

- 8 Morgan Stanley

- 9 Citigroup

- 10 Royal Bank of Scotland

You might wonder why the Banque de France doesn't simply buy those bonds directly from the French government. I suppose that the reason is that article 123 paragraph 1 of the Lisbon Treaty forbids such purchases.

But here's the really intriguing question. When banks like BNP Paribas buy French government bonds, do they make those purchases with pre-existing money - i.e. money that has been deposited with them by savers? Or could it be that, since commercial banks like BNP Paribas can create money out of thin air (as revealed by the Bank of England), that they actually buy up those French government bonds with newly created money?

If that is true, it seems to me that this wonderful new system invented by Mario Draghi and his collaborators at the ECB may potentially be the most incredible racket yet devised. Commerical Banks like BNP Parisbas, Morgan Stanley and Crédit Agricole, may be in the process of buying billions of euros worth of government bonds using non existent money, which they can then sell to Central Banks in exchange for real money - freshly minted with the authorisation of the ECB. If this is true, it is a truly amazing way to transfer Central Bank money directly into the pockets of some of the richest bankers on the planet.

Methinks that it is time to put an end to this. We need QE for the People - now!

No comments:

Post a Comment