It's the time of year when I like to have a look at how financial transactions were doing in 2013. Many of the key players are quite keen to boast about just how much activity they are handling.

For example, CLS group has a report saying that it handled an average of $4.99 trillion a day in 2013. up from $4.89 trillion a day in 2012. With roughly 250 trading days in a year, that would total $1250 trillion.

As I reported yesterday, NYSE Liffe (which does something like 99% of its trading through its London Office) has reported handling €474 trillion in 2013.

LCH.Clearnet Ltd has a graph on its web site showing monthly notional volumes for its SwapClear trading arm.

By clicking on the histograms for each month I found that the total for 2013 added up to an impressive $507.8 trillion. Interestingly, the numbers for the start of 2014 are looking particularly strong, with $61.6 trillion in january and $49.8 trillion in February.

LCH.Clearnet Ltd's Fixed Income's website reports the "key fact" that it handles €11.8 trillion repo trades per month based on nomimal values. Over 12 months that would suggest that it handled €141.6 trillion in 2013.

The CHAPS Co Website has the following graph showing monthly volumes and values.

And you can read that "The total value transmitted in CHAPS in 2013 was £70.1 trillion, an average of £277 billion daily."

The BACS system, which is used to process many direct debit and account transfers in the UK published a bulletin in January 2014 intitled "Record breaking year for BACS" in which it said that " Direct Debit continued to grow, topping 3.5 billion across the course of the year, with a total value of £1.1 trillion. With Bacs Direct Credit payments, that made for a combined 5.7 billion items processed in 2013, worth almost £4.2 trillion."

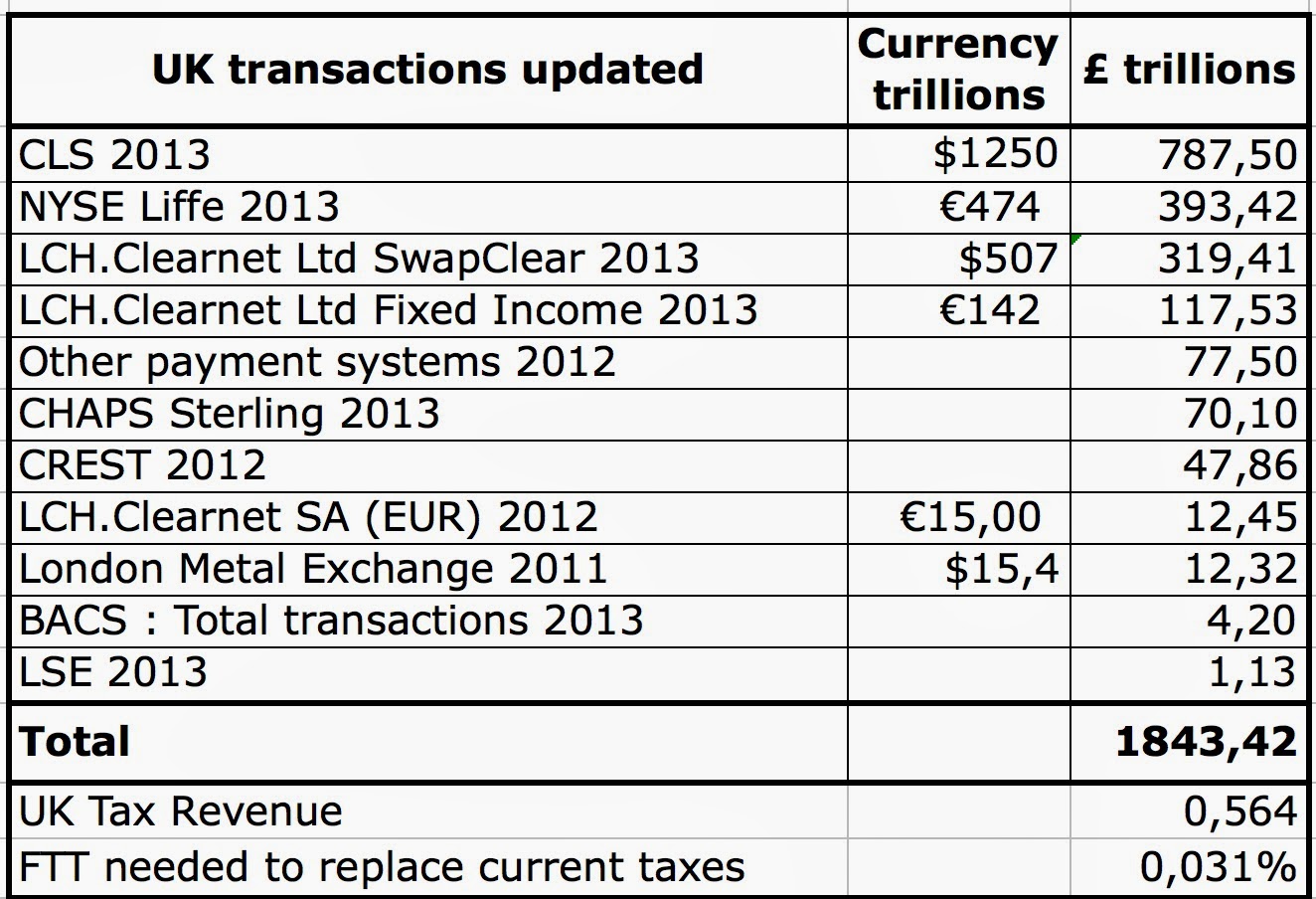

Adding in the numbers, together with some other figures that I have for things like London Stock Exchange and the London Metal Exchange and older figures for other payment systems from the BIS, I get the following table showing at least £1843 trillion in UK-based transactions for 2013. This compares with the figure of £1760 trillion that I generated two years ago. Clearly the financial markets have not been too seriously hit by the recession.

The table also compares the amount of transactions with the total tax revenues for the UK government - namely £564 billion (nicely plotted in a very recent pie chart on the Guardian's web site). The ratio between transactions and tax (over 3260:1) suggests that you could actually get rid of every UK tax and replace the whole lot with a single flat-rate FTT on all financial transactions of 0.031%. Those who follow my blog will know that I have pushing this possibility since october 2010.

But even the £1843 trillion number must be an underestimate. For example, I have no idea how much trading is being done by Barclay's Bar-X platform. And LCH.ClearNet Ltd has a number of other business streams for which I have not been able to find numbers, in addition to SwapClear and Fixed Income. Specifically:

If anyone knows how to find the value of the transactions in these areas, do let me know.

Note added 15th April 2014 : I've just found a website where Barclays says that their Bar-X platform handles $50 billion a day. With roughly 250 tradings days a year, that means that we can add in an additional £7.5 trillion at least. But I found another site that says that the Barclays system handles up to 1000 trades a second. I suspect that the £7.5 trillion may be conservative.

NCDEX:

ReplyDeleteBUY REF. SOYA APR. AT 582 TGT

583,584, 585 SL 580

BUY

REF. SOYA APR. CALL DID OUR FIRST TGT OF 583

NCDEX AGRI Tips