Today is a sad day. It is armistice day in France - the 11th of November. It's the day we remember the hundreds of thousands who lost their lives in a particularly stupid war that started 100 years ago. Today, the french president François Hollande is inaugurating a magnificent memorial at Notre-Dame-de-Lorette. It is a ring of concrete 328 meters long, with the names of roughly 600,000 men and women who made the ultimate sacrifice. Their names are listed in alphabetical order - all nations together, with no indication of rank. There are 294,000 British names, 174,000 Germans, 106,000 French and other names from a total of over 30 different countries that

include India, South Africa, Australia, New Zealand, Vietnam, Laos... The memorial makes it clear that everyone loses in the madness of war.

Everyone? Well, not quite. While hundreds of thousands of troops were being subjected to inimaginable suffering in the trenches, there were in fact some people who were presumably very happy to see the ongoing slaughter.

Last week, my blog included an amazing chart showing the interest payments made by UK taxpayers on public sector debt since the creation of the Bank of England in 1694. I was struck by the fact that those interest payments were always particularly high in the period following wars. One of the clearest examples was the period from 1922 to 1933 when the amount that UK taxpayers paid in interest never dropped below 8% of GDP.

Let's have a look at another graph - also provided by the excellent UKPublicSpending website that provided last weeks figures. This one shows the level of UK public sector debt as a percentage of GDP, again since the creation of the Bank of England.

You can see that the debt levels rose steadilly thoughout the 18th century to reach a peak at 260% of GDP in 1819 - thanks no doubt to the British Government's string of wars at the start of the 19th Century - there were 21 different wars engaged between 1800 and 1819.

Things actually went pretty well for the rest of the 19th century, with debt levels dropping almost continuously. By 1914, public sector debt had dropped to just 25% of GDP.

But then, the First World War broke out, and public sector debt soared more than five-fold to reach 135% of GDP by 1919. The debt levels remained very high, peaking at 181% in 1923 and were still over 177% in 1934. This was a period that were really boom years for the bankers, who were raking it in - as illustrated in the graph of interest payments as a percentage of GDP.

Debt levels started to drop a bit after 1934, and reached 109% in 1940. But, fortunately for the bankers, World War II stepped in, and public sector debt rocketed again to reach 238% of GDP in 1947.

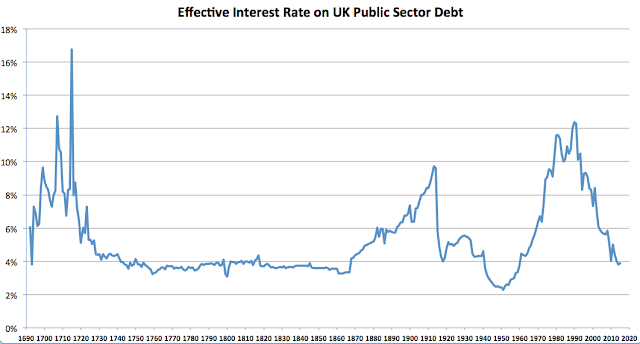

By combining the graph of Public Sector Interest Payments that I provided last week, with this week's Public Sector Debt chart, I have been able to generate a third graph. This one plots the effective Interest Rates being paid on Public Sector Debt since the creation of the Bank of England. Here it is.

As you can see, the first 30 years or so of the Bank of England, it wasn't yet clear how much the Bankers could get away with. The rate was going up and down, with a whole series of peaks. The highest value was seen in 1715 when they had the nerve to charge a massive 16.8%. Not quite as terrible as we currently have to pay for credit card loans, and nowhere near the 14348% charged by some Payday Loan companies in the UK, but impressive none the less.

After about 1740, the system was clearly well in place, and the interest rates stayed stubbornly at around 4% until about 1870. From that point on, the Bankers edged up the rate a bit every year until it peaked at 9.7% in 1913. The climb looks so linear that I would be tempted to suggest that it was deliberately manufactured that way. At that point, I guess they decided that if they wanted the government to really go into massive levels of debt to pay for the First World War, they better ease off a bit and so the interest rates dropped back to the 4% level that the banks had been charging for nearly 150 years in the 18th and 19th Centuries.

During the rest of the 20th century, you can see that they again were relatively modest in their claims until about 1950. After that, the rates edged up and up throughout the 60s, 70s and 80s to reach a new peak of 12.4% in 1990 - something that the banks hadn't managed since 1715.

Now. Here's the vital thing you have to understand. When commercial banks make loans to the UK government, they don't actually have the money they lend. As the Bank of England has recently admitted, when Banks make loans they literally just create the "money" they lend out of thin air. That's true when they make loans to people like you and me, or when they make loans to businesses. But it's also true when they make loans to Governments.

Yes, that's right David Cameron. There is a "magic money tree". There's one in every single Commercial Bank. And if they can get some gullible politician to take on debt to pay for a war, then they have a guaranteed stream of income - for doing nothing. It is quite simply breathtaking - and the most mind-blowing con trick ever devised.

Since the creation of the Bank of England, which set the model for all the current banking systems throughout the world, it has become standard practice for bankers to offer as much "money" to governments as they like. The only question is how much they can get the stupid (or complicit) politicians to sign up for.

And if you can get the politicians to start fighting a war, then that is absolutely perfect. Since the banks can create as much debt as they like by making "loans" with non-existent money, the more wars there are, the better it is for the bankers.

Can I prove that the First World War was deliberately started as as racket to allow the Bankers and their friends to suck an even more obscene amount of money out of taxpayers pockets? Maybe not. But I think that we owe it to the 600,000 dead in the First World War to find out the truth.

Encore une parodie de réflexion sur des sujets qui méritent bien mieux.

ReplyDeleteMarc,

ReplyDeleteSorry, can you explain this comment? As it stands, it has no utility. I'm tempted to consider it as spam.

Simon