With my proposition for a standard 1% annual tax on all net wealth, the question arises of who will end up paying. To what extent would such a tax system help generate a fairer society by making the rich contribute more

Well, I found an amazing dataset from the UK's Office for National Statistics called "Individual Wealth: wealth in Great Britain". You can download the dataset as an Excel file here. I actually much prefer this to the "household wealth" measures that are often reported. And it makes the data directly comparable to the UBS Global Wealth Reports which also use individual data.

They provide data for 6 different periods, as you can see in this table, which contains both raw data and inflation adjusted figures for both the median and mean values.

So, you can see that there has been a roughly 23% increase in inflation adjusted median wealth in 20 years. Mean wealth has improved by 32% over the same period.

In the following, I have only taken the latest data, although if you are keen, you can see how any of them has changed over 20 years.

I had already mentioned the importance of age, but the ONS provides four different ways of breaking down by age bands. Take your pick. The effect of age is clearly enormous. Young families would tend to pay much less.

Another really important factor is ethnic origin. Just take a look at the results in the four different breakdowns provided by the ONS. Whites are clearly much wealthier than any other group. No huge surprises I guess, but it is amazingly clear just how bad things are.

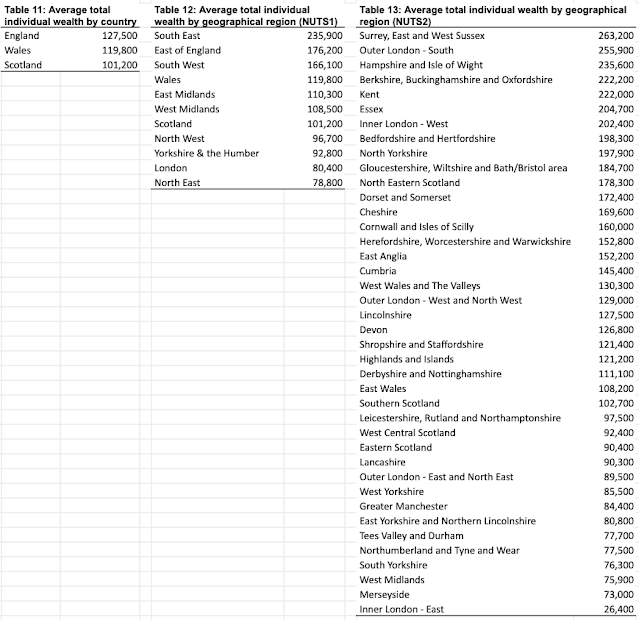

Note that in all the following data sets, I have simply sorted the rows so you can see where individual wealth is highest.

Next comes regional variations. Here they are. Again, not really surprising, but amazingly clear.

You can also get a breakdown by type of region, again with various ways of doing it.

You would like to know how wealth depends on the educational and employment characteristics of your parents? Here are the details. Clearly, if your parents left school early, and did not have good jobs, your hopes of ending up wealthy are greatly diminished. No huge surprises I guess, but amazingly clear.

There are tables that show net wealth as a function of sex and sexual orientation. On average, men are 12% wealthier than women.

When you are working, here's what you should do to get wealthy.

And finally, three tables that show the impact of the your origins, type of family unit, and whether your own your own home, are paying off a mortage or renting. The figures are sobering. On average, home owners are 21 times more wealthy than renters.

It's all absolutely fascinating. But it also shows that the degree to which people are wealthy or not depend enormously on factors that are beyond their control. You are not necessarily wealthy because of your talent, or how hard you work. There are other factors that mean that the playing field is anything except level. So much for the ridiculous idea that people are poor because they are lazy.

For every one of these factors, it seems obvious that a simple 1% annual tax on net wealth would help build a fairer society by allowing governments to help the less fortunate. With £148 billion of revenue coming from this simple measure, the UK government could do a huge amount to help improve society.

You want to bias things in favour of young families? A 1% wealth tax would help.

You want to level up the country? A 1% wealth tax would help.

You want to reduce the inequalities due to your parents? A 1% wealth tax would help.

You want to favour people in professions that don't pay well? A 1% wealth tax would help.

These arguments are based on figures for the UK. But I am convinced that the same story would apply just ahout anywhere. No need to target millionaires and billionaires. A simple net wealth tax would make for a much fairer society. I would vote for it, except that there are no political parties who are proposing such a scheme.

No comments:

Post a Comment